DP World, NIIF to buy Continental Warehousing for

$400-M

Economic Times

Hindustan Infralog, an investment platform jointly

promoted by Dubai’s port operator DP World and India’s

National Investment and Infrastructure Fund (NIIF), is

buying a 90% stake in Continental Warehousing

Corporation (Nhava Seva) for USD 400 million from its PE

investors. The existing promoters will retain a 10%

share. Continental Warehousing, the flagship company of

Chennai-based NDR Group, owns and operates

cargo-handling facilities such as container freight

stations (CFS), multimodal cargo handling terminals (MMTs)

and private freight stations. It also provides express

cargo and third-party logistics services. Barclays,

Citi and Deutsche Bank were the

advisors in the transaction.

Private Equity firms Warburg Pincus, Abraaj and IFC

Washington together own 60% of the company, with the

former being the single-largest shareholder with a 40.4%

stake. Abraaj and IFC own 20% while the remaining 40% is

held by N Amrutesh Reddy, executive director and

promoter. Having invested USD 100 million in 2011,

Warburg will make a return of nearly three times. Abraaj

got the stake when it acquired private equity firm

Aureos Capital in 2012. IFC is a recent investor, having

pumped in USD 65 million through a mix of debt and

equity in 2015.

Continental has reported around INR 90 crore EBITDA on a

INR 750 crore top line in FY17.

Private Equity Fund Investments

ICICI Securities raises

Rs.1,718-Cr from anchor investors

Economic Times

ICICI Securities, ICICI Bank's broking arm, has raised

INR 1,718 crore through allotment of shares to 58 anchor

investors. ICICI Securities allotted 3.3 crore shares at

INR 520. International anchor investors to the issue

included Temasek, Fidelity, Fairfax, Nomura, Amansa

Holdings and BlackRock. Domestic funds which invested in

the anchor allotment included HDFC MF, DSP BlackRock,

Reliance MF, Premji Invest, SBI MF, Birla MF and IDFC

MF.

ICICI Bank aims to raise about INR 4,000 crore at the

upper end of the price band by selling 7.7 crore shares

representing 24% stake in ICICI Securities.

Feedback Infra raises Rs 685-Cr from ADV Partners

Economic Times

ADV Partners has invested INR 685 crore in Feedback

Infra, which provides advisory services to the

infrastructure and also manages operations and

maintenance for power projects and roads. As part of the

transaction, L&T has transferred its stake completely to

ADV and IDFC has reduced its stake in compliance with

banking regulatory norms. Part of the primary proceeds

will be to reduce current debt. Khaitan & Co

acted as the Indian legal advisors and advised

Feedback Infra Private Limited on this

noteworthy transaction. Axis Capital

acted as the Sole transaction advisor to

Feedback Infra Group.

KKR-Emerald Media invests $80-M in sports-tech co GSC

Press Release

KKR-backed Emerald Media has acquired a significant

minority stake in Singapore- and Chennai-based sports

technology and management company

Global Sports Commerce

(GSC), through a combination of primary and secondary

transactions. The total investment of about USD 80

million will include the secondary purchase of existing

investor FidelisWorld’ stake and primary growth capital.

Veda Corporate Advisors advised the company on

the transaction. ADV Partners (which had invested in

Nov-15) will continue to hold a significant minority

stake in the company. The growth capital will enable GSC

to explore acquisitions and develop new technologies for

the sporting eco-system and also expand operations in

digital sporting solutions markets across the globe.

GSC has a worldwide presence with offices in 16 cities,

across 10 countries. It combines technology solutions in

the fields of LED signage, sponsorship management,

premium consulting, fan engagement, AR/VR, drone-based

data acquisition, wireless tech and data-sciences with

professional expertise from all over the world.

Franchises that GSC has partnered with, include FIFA,

English Premier League, NRL Australia, Australian

Football league, IPL, Formula 1, Big Bash League, New

Zealand Cricket, Cricket Australia, IMG and Asia Sports.

From the Venture Intelligence

PE-VC Deal Database: FidelisWorld had

invested about INR 127 Cr in GSC (then called Technology

Frontiers) in Mar-14. (Subscribers to the database can

login to view the valuation, deal structuring and other

transaction details.)

E-grocer

Grofers raises Rs.400-Cr in downround led by

SoftBank

Times of India

SoftBank is leading a INR 400-crore financing

round in online grocery startup Grofers, taking

its shareholding up to as much as 35-40%.

Existing investor Tiger Global also participated

in the fundraise along with Russian tech

billionaire Yuri Milner. Grofers’ valuation has

dropped 20% to USD 300 million after the

investment compared to what it fetched in its

previous funding of USD 120 million at the end

of 2015.

While SoftBank invested USD 40 million, Tiger

Global — which holds around 25% in the e-grocer

— invested USD 15 million, with the rest coming

in from Milner. Sequoia Capital, the first

institutional investor in the Gurgaon-based

startup, did not participate in the latest

funding.

Blackstone to buy 80% in Pune’s Nitesh Hub mall

for Rs310-Cr: Report

Mint

Blackstone Group is set to buy an 80% majority

stake in Nitesh Hub, a shopping mall in Koregaon

Park, Pune from real estate firm Nitesh Estates

Ltd for around INR 310 crore. Nitesh Estates

will retain the balance stake. Existing investor

Goldman Sachs Group Inc. will exit the project.

The mall is going to be turned into a mixed-use

development which will have retail and office

space along with food and beverage and

entertainment facilities.

In 2015, Nitesh Estates had bought Park Plaza

Centre, a shopping mall, in Pune’s Koregaon area

for INR 250 crore from Israeli firm Elbit

Imaging Ltd. Goldman Sachs had backed the

acquisition with $37 million.

Chargebee raises $18-M

led by Insight Venture Partners

Press Release

Chargebee, a

SaaS subscription management and recurring

billing solution, has secured $18 Million in

growth capital, led by New York-based Insight

Venture Partners. The Series C investment also

saw participation from previous investors, Accel

India and Tiger Global Management. With this

round of funding, the total investment raised by

the company stands at $24.7 million. The new

capital will be used for increased investment in

product R&D, sales, marketing and growth, to

expand aggressively into newer markets and

segments.

Zappfresh raises Rs 20-Cr from SIDBI VC, Dabur’s

Amit Burman

Mint

Online meat store Zappfresh has raised INR 20

crore from Dabur India vice-chairman Amit Burman

and SIDBI Venture Capital. The company supplies

cold-stored fresh meat like chicken, mutton and

sea food to customers in Delhi and parts of the

National Capital Region. Zappfresh will use the

proceeds from this round to expand its teams and

increase capacity as it looks to bring the

service to other cities.

CRM

s’ware startup ZineOne raises $2.5-M from

Omidyar Network, others

Press Release

ZineOne, a

customer engagement hub that uses AI to provide

banks and retailers with the ability to engage

with their customers in a personalized manner.

has raised $2.5 million in a Series A round led

by Omidyar Network. Other investors in the round

include Harvard Business School Alumni Angels,

Touchstone Equities, as well as existing

investors Hyderabad Angels and Golden Seeds. Anthill Ventures was the advisor to this

round. The round takes ZineOne's total venture

capital raised to $5 million. The company

intends to use the newly raised funds to

accelerate sales, marketing, and execution of

its product roadmap.

Exfinity Ventures invests $2-M

in US-based AgShift

Mint

Exfinity Venture Partners has invested $2 million in AgShift, a

California-based start-up developing technology to inspect and grade

food produce using deep learning and computer vision. The start-up is

currently working with select clients in the food industry to test its

solution.

Green-tech startup

Facilio raises $1.5 M from Accel

Economic Times

Chennai-based green-tech startup

Facilio has

raised USD 1.5 million from Accel India. The

startup offers an integrated facilities

management software to manage building

operations, maintenance and sustainability

performance, across a portfolio of buildings.

Infy

invests addnl $1.5 M in US-based data science

firm Waterline

BSE

Infosys, through the Infosys Innovation Fund,

has made a follow-on investment of USD 1.5

million in

Waterline Data Science,

a Mountain View, CA (USA)-based provider of data

discovery and data governance software. Infosys

had made an initial investment of USD 4 million

in the company in January 2016.

Waterline Data Science provides data scientists

and business analysts a self-service data

catalog to help discover, understand and

provision data, and an automated data inventory

that enables agile data governance across

metadata, data quality and data lineage.

Voice tech startup

Slang Labs raises Rs.8.12 Cr from Endiya

Partners

Mint

Bengaluru-based Slang Labs has raised INR 8.12

crore from venture capital firm Endiya Partners.

The startup develops mobile software for

accepting voice commands in English and Indian

languages and is in talks with more investors to

raise additional funds. The start-up will sell

to other tech start-ups and established

companies in segments including news and media,

travel and ticketing, online delivery,

logistics, and fintech. Slang Labs is co-founded

by Kumar Rangarajan, who had earlier sold his

start-up Little Eye Labs (which was also backed

by Endiya Partners) to Facebook in 2014. Sateesh

Andra, Managing Director, Endiya Partners had

joined the company's board in February 2018.

CustomerSuccessBox raises $1-M

from pi Ventures, Axilor Ventures

Press

Release

Gurgaon-based CustomerSuccessBox, an ‘actionable’ customer success

platform for B2B SaaS companies, has raised USD 1 million in a Pre

Series A round of funding led by pi Ventures with participation from

Axilor Ventures. The funding will be used to drive growth and product

innovation.

CustomerSuccessBox, founded in 2016 by Puneet Kataria (Founder & CEO)

and Amritpal Singh (Co-founder & CTO) is a customer success platform

which helps B2B SaaS companies reduce, churn and grow their recurring

revenue. It is being used by B2B software companies including XebiaLabs,

WizIQ, Synup and WoowUp. Its patent pending technology has processed

over 30 million data points from over 100,000 end users to calculate

Account Health Scores.

Karma

Healthcare raises Rs.3-Cr from 1Crowd, Ankur

Capital & Others

Economic Times

Rajasthan based healthcare startup Karma

Healthcare has raised INR 3 crore in equity

funding from 1Crowd, existing investors Ankur

Capital, Ennovent Capital, Beyond Capital, and

angel investors including Anil Chatta, a

healthcare professional based in the Middle

East.

Karma Healthcare claims to have achieved over

50,000 consultations and operates 10 e-Doctor

clinics in Rajasthan and Haryana, providing

clinical treatment, medicines and diagnostic

services. The company is supported by marquee

organizations such as the Tata Trusts, UBS

Optimus Foundation and WISH Foundation.

Edtech co. Eupheus raises capital from

Sixth Sense Ventures

Times of India

Sixth Sense Ventures, from its second fund, has invested in

technology-led learning platform Eupheus Proficiency Learning. The

target company works with over 1,500 schools to provide them with

interactive learning solutions and reference contexts for textbooks. The

company is planning to use the funds to expand its presence to south

India, and introduce home learning solutions. The company expects to

report INR 18 crore in revenue this year along with operational

profitability.

SIDBI VC

invests in solar water pumps maker Claro Energy

SIDBI VC

SIDBI VC, via its Impact Investments focused Samridhi Fund, has

invested in Delhi-based

Claro Energy Private Limited (CEPL)

which specializes in installation and maintenance of solar

water pumps.

Angel Funding

P2P lender i2iFunding raises

Rs.5-Cr in addl angel funding

Business Standard

Peer to peer lending platform i2iFunding.com has announced raising a

second round of angel investment worth INR 5 crores. The round has been

led by SucSEED Venture Partners; Manish Poddar, a serial entrepreneur

and investor; and a group of other angel investors from consulting and

private equity firms, The investment will be utilized for strengthening

technology, infrastructure and geographical expansion. Over next two

years, the company aims to grow to INR 15-20 crores worth loans every

month (from about INR 1 crore per month currently). It has more than

50,000 registrations with about 3,000 active lenders.

Cryptocurrency player

Nuo Bank raises seed funding of $250-K

Economic Times

PayU India CEO Amrish Rau and managing director

Jitendra Gupta have together invested USD

250,000 in Mumbai-based Nuo Bank. The startup

uses cryptocurrency and blockchain to replicate

a bank that will have a decentralized, global

and transparent cryptobanking platform.

Micro-jobs provider GigIndia

raises seed funding

Inc42

Pune-based GigIndia, which provides micro-jobs to students, has raised

seed funding from a consortium of angel investors including Jessica

Wong, Founding Managing Partner of Ganesh Ventures; Hiro Mashita,

Director at M&S Partners; Xue Manzi, Director-Manzi Fund and Yiyun

Zhang, CEO at Pocket Part Time. The proceeds will be used for expansion,

hiring of staff and for shaping the product with automation techniques

to enhance the user experience.

Founded in 2015 by Sahil Sharma and Aditya Shirole, GigIndia offers

part-time work opportunities for students to help them earn as well as

build their CV for their future jobs. The company promises micro-jobs

with biggies like Alibaba, Xiaomi, SHAREit, Uber, and Paytm.

Social VC Investments

Packaged

foods brand Soulfull raises Rs.35-Cr from Aavishkaar

Economic Times

Impact investor Aavishkaar, through its $200 million Aavishkaar

Bharat Fund, is to invest INR 35 crore into packaged foods

startup Kottaram Agro Foods that markets products under the

brand “Soulfull’.

The Bangalore-based firm is reviving traditional grains - such

as millets - into healthy breakfast and snack options such as

flakes, Ragi bites, muesli and ready-to-cook oat-millet meals.

Jerome Merchant + Partners advised

Aavishkaar Bharat Fund. Trilegal advised

Kottaram Agro Foods Private Limited.

Financial

inclusion firm Basix Sub-K raises Rs.35-Cr from

Accion, NMI

Dealstreetasia

Hyderabad based Basix Sub-K

iTransactions Ltd, a technology company focused

on financial inclusion, has raised nearly $5.4

million (INR 35 crore) from Accion and Nordic

Microfinance Initiative (NMI), among others.

Intellecap served as the investment banker

for the deal. Basix Sub-K iTransactions, a part

of the BASIX Social Enterprise Group, will use

the funds for expansion of its agent banking

network and credit facilitation for micro and

small businesses.

Incorporated in 2010,

Basix Sub-K offers financial services through a

network of basic convenience outlets in 23

states and manages a loan portfolio of INR 666

Cr for various banks. It has deployed 13,000

agents to interface with customers.

From the Venture

Intelligence PE-VC Deal Database:

In 2011 & 2012, Michael and Susan Dell

Foundation had invested about $1 million in

Basix Sub-K. (Subscribers to the database can

login to view the valuation, deal structuring

and other transaction details.)

Impact Micro Ventures, mPokket

get $50-K each from VilCap

Economic Times

Impact Micro Ventures and mPokket, both early-stage financial health

startups, will receive USD 50,000 each from VilCap, the venture capital

fund affiliated with Village Capital, with support from PayPal,

BlackRock and FMO.

Bengaluru-based Impact Micro Ventures uses big data to help un-banked

microenterprises access financing and improve their cash flow. Kolkata-based

mPokket provides microloans via a mobile app.

Liquidity Events

India Value Fund sells TD Power

Systems shares worth Rs 12-Cr, registers 0.79x return

India Value Fund, via India Value Fund IV, has sold 348,531 shares at

INR 201.01 per share on BSE and 252,246 shares at INR 201.05 per share

on NSE of publicly listed TD Power Systems Ltd. on Mar 19, 2018. The

sales, which constituted 1.81% stake, aggregated to INR 12.08 Cr.

Post-deal, the investor holds 1.86% stake (618,194 shares) in the

company.

From the Venture Intelligence PE-VC Deal Database:

In Aug 2011, India Value Fund invested INR 31.21 Cr for 3.67% stake at

INR 256 per share as part of anchor investment.

Other Private Equity/Strategic Investments

Consumer

electronics firm iBall raises Rs.53-Cr

Venture Intelligence

Research

Mumbai-based Best IT World (India) Pvt. Ltd,

which owns consumer electronics brand

iBall, has

raised INR 52.67 crore from a group of investors

led by Varun Daga (Founder, Girik Capital) and

Shreans Daga who invested INR 12.5 crore each.

The deal, concluded in February 2018, provides

the company with a post money valuation of

between INR 169-188 crore. J Sagar Associates

acted as legal advisors to the investors.

Balrampur Chini invests

Rs.37.5 Cr in education sector lender Auxilo for

50% stake

Business Line

Balrampur Chini Mills has invested about INR

37.5 crore in Mumbai-based startup Auxilo

Finserve, an RBI-registered NBFC lender in the

education sector, in lieu of 50% stake. The

remaining 50% will be held by Enam Holdings’

Akash Bhanshali. Both the investors have

committed to make further investments of INR 350

crore in the next three to four years through

multiple tranches, with each investing about INR

175 crore.

Auxilo provides loans to students for higher

studies (global and domestic) and educational

institutes for infrastructure modernisation. The

company, which started operations in October

2017, has presence in Mumbai, Hyderabad,

Chennai, Delhi, Bengaluru and Pune.

Analytics startup Flutura raises

$1-M from Hitachi

Bengaluru-based IoT startup Flutura Decision Sciences and Analytics had

raised USD 1 million in Series A1 funding from Japan firm Hitachi

Hi-Tech Solutions in Dec-17. The valuation of the company was 88% higher

than the previous round that happened in Feb-17.

From the Venture Intelligence PE-VC Deal Database:

In Feb-17, Flutura raised USD 7.63 million in Series A

funding. The round was led by Vertex and supported by Pi Ventures, Lumis

Partners, The Hive and a few angels. (Subscribers to the database can

login to view the valuation, deal structuring and other transaction

details.)

Chatbot

startup One Labs attracts funding from Micromax

Economic Times

Micromax has invested in a consumer technology

and artificial intelligence based startup 'One

Labs', which has developed chat bot like Apple's

Siri and Google Assistant. One Labs has

developed 'inOne' platform which provides access

to apps across multiple genres from food,

shopping, travel, deals, cabs, news, recharge,

games etc within a single app. In addition, One

Labs has created an AI enabled voice or chatbot

solution called One Assistant which packages

services provided on 'inOne' in a virtual

assistant format.

IPOs

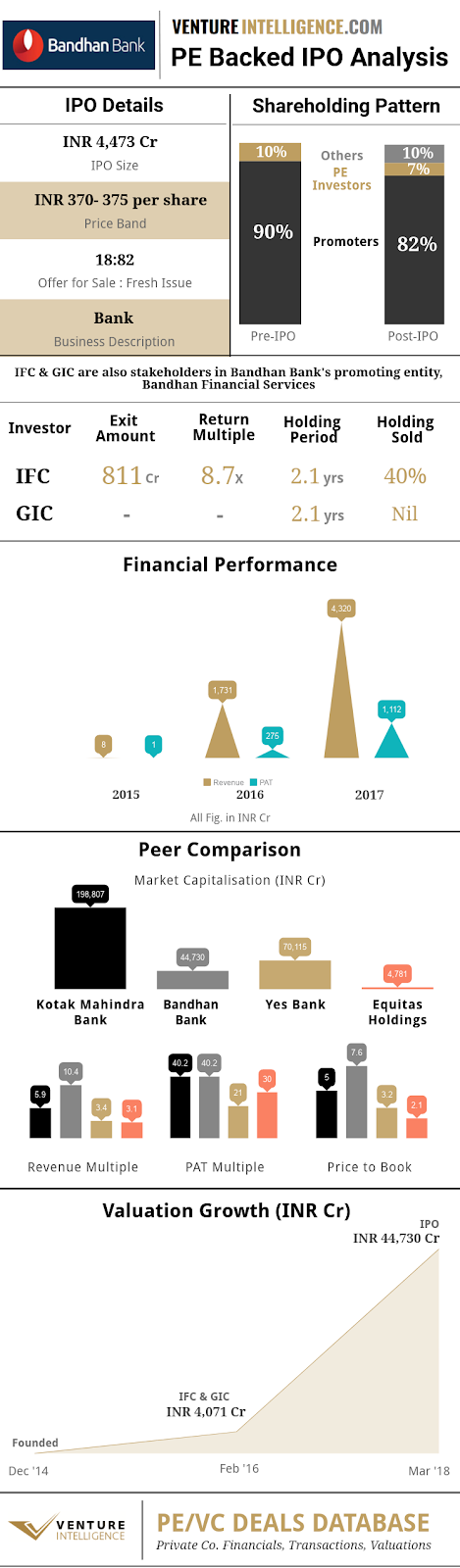

Bandhan Bank IPO

oversubscribed ; IFC to realize INR 814-Cr

Economic Times

The initial public offering (IPO) of Bandhan Bank got

subscribed by 14.62 times. The IPO received bids for

1,22,10,47,920 shares as against the total issue size of

8,34,96,347. The QIB quota saw 38.68 times subscription,

while the NII (Non-Institutional Investors) category was

subscribed 13.89 times. RII (Retail Institutional

Investors) saw 1.19 times subscriptions.

The IPO comprised a fresh issue of 9,76,63,910 shares,

an offer for sale for up to 1,40,50,780 shares by

International Finance Corp (IFC) and up to 75,65,804 by

IFC FIG Investment Co. The price band was fixed between

INR 370 and INR 375 per share, with a face value of INR

10 each. Kotak Mahindra Capital, JM Financial,

Goldman Sachs and JP Morgan are the book

running lead managers of the issue.

From the Venture Intelligence

PE-VC Deal Database: IFC first invested

in Bandhan - when it was still an NBFC MFI - in 2011.

GIC is another PE investor in the Bank. (Subscribers to

the database can login to view the valuation, deal

structuring and other transaction details.)

Autocomp

maker Sandhar Technologies’ Rs.512-Cr IPO

subscribed 3.31 times

MoneyControl

The initial public offer of auto component maker

Sandhar Technologies was subscribed 3.31 times.

The IPO to raise INR 512 crore received bids for

5,15,34,900 shares against the total issue size

of 1,55,74,311 shares. Bulk of the demand came

from institutional investors (subscribed 14.5

times). The portion of retail investors was

subscribed 1.2 times, while that of high net

worth individuals, 6.5 times.

The public offer comprises fresh issue of shares

worth INR 300 crore and an offer for sale of up

to 64 lakh shares (including anchor portion of

46,30,842 shares). The price band for the IPO

was fixed at INR 327-332. ICICI Securities

and Axis Capital are managing the

issue.

Karda

Constructions’ IPO subscribed 2.49 times

Business Standard

The initial public offer (IPO) of Karda

Constructions has received bids for 1.07 crore

shares and was subscribed 2.49 times. Karda

Constructions is engaged in the business of real

estate development in Nashik, Maharashtra. The

price band for the issue was INR 175-180 per

share. The issue comprised fresh issue of 23

lakh equity shares as well as offer for sale

(OFS) by the promoters. The company plans to use

the proceeds towards part repayment of overdraft

facilities and term loans and for general

corporate purposes.

Hindustan Aeronautics IPO falls short of 100%

subscription

Mint

The INR 4,229 crore initial public offering

(IPO) of state-owned Hindustan Aeronautics Ltd

(HAL) witnessed an overall subscription of 99%.

While the portion of shares reserved for

institutional investors in the HAL IPO received

a firm response, those reserved for other

categories of investors were under-subscribed.

The portion of shares reserved for institutional

investors in the HAL IPO saw a subscription of

1.73 times or 173%, while those kept aside for

retail investors and high net-worth individuals

(HNIs) were subscribed to the extent of 38% and

3%, respectively.

HAL had set a price band of INR 1,215-1,240 per

share for the public offering. HAL’s IPO is a

pure secondary offering, where the government of

India is selling a total of 34.10 million

shares, representing a 10.2% stake in the

company. HAL is engaged in the design,

development, manufacture, repair, overhaul,

upgrade and servicing of aircraft, aero engines,

helicopters, avionics, accessories and aerospace

structures.

HDFC MF to make private

placement of 16 lakh shares ahead of IPO

Economic Times

HDFC Mutual Fund will go for a private placement of 16 lakh shares, a

bulk of it to distributors, before its IPO opens as per the DRHP filed

with the regulator. These shares will have a lock-in period of one year.

The shares are being offered to only IFAs who do business with the

company as entrepreneurs. This is in addition to the 7.2 lakh shares the

AMC has kept reserved in the IPO for distributors. Regulatory rules

stipulate that an offer for private placement can be made to not more

than 200 people in a financial year and hence this offer will be made to

only 199 distributors

M&A

EESL arm acquires UK’s

Edina Power for Rs 493-Cr

Press Release,

Economic Times

EPAL, a joint venture between state-run Energy

Efficiency Services Limited (EESL) and UK-based

EnergyPro Limited, has acquired combined heat

and power utility Edina Power Systems Limited in

UK Pounds 55 million (INR 493 crore). The

advisors to the deal included KPMG, Bowline

Capital Finance, Lux Nova and Verco

Global.

Edina supplies, installs and maintains CHP, gas

and diesel power generation systems. It employs

200 people across its UK headquarters in

Manchester and manufacturing base in Lisburn,

Northern Ireland, and provides work for 400

contractors. Edina also has a small operation in

Australia.

Zensar

to buy US-based insurance focused IT Services

firm Cynosure for $33-M

BSE,

Economic Times

Zensar Technologies Ltd, an RPG Group company,

is to acquire US-based Cynosure Inc for USD 33

million. Zensar will acquire the entire share

capital of Cynosure Interface Solutions Pvt Ltd

and its wholly owned subsidiary, Cynosure Inc.

The target company is headquartered in Chicago

and has an offshore development centre in

Bengaluru. The acquisition will be funded by a

mix of internal accruals and external debt.

Cynosure focuses on providing guidewire platform

implementation services to Property and Casualty

(P&C) insurance carriers and posted a revenue of

about USD 20 million in 2017. The target, with

over 150 employees, will become a part of Zensar’

s Insurance vertical. Post-acquisition, Cynosure

will continue to be managed by Sid Wadhwa, CEO &

Co-founder.

OYO buys service aptmts

operator Novascotia for $1-M

Economic Times

Online hotel aggregator OYO has acquired

Chennai-based service apartment operator

Novascotia Boutique Homes for USD 1 million

(about INR 6.71 crore), marking its first major

buyout as well as establishing its presence in

the service apartment and corporate executive

stay segment.

Novascotia manages 350 rooms in Chennai,

Coimbatore, Hyderabad, Kochi and

Thiruvananthapuram and has 64 employees, who

will be absorbed by OYO.

Vital

Wires acquires design studio Two55am for $500-K

Economic Times

Boutique SAP solutions provider Vital Wires has

acquired fellow Gurgaon-based product innovation

venture Two55am for about $500,000.

Additionally, Sumit Gandhi, who was leading

Two55am, will now join the merged entity as

partner, and will also head its global

enterprise digital practice. The entire team of

the design and UX studio has also been absorbed.

Hero MotoCorp ups stake

in Colombia JV to 68%

BSE

Hero MotoCorp Ltd, through its wholly owned

subsidiary HMCL Netherlands B.V. (HMCL), is to

invest USD 10,500,600 towards acquisition of 30

Million Compulsorily convertible preference

shares (CCPS) which on fully diluted basis

increase the shareholding from 51% to 68% in

HMCL Colombia S.a.S, which is engaged in the

business of manufacture, assembly and

distribution of two wheelers in Colombia. The

company recorded a turnover of USD 25.8 million

in 2016-17.

Videocon

sells 51.32% stake in general insurance arm

Press Release

Videocon Industries has sold its 51.32% stake in Liberty Videocon

General Insurance Company to Diamond Dealtrade Ltd (a DP Jindal

Group Company) and Enam Securities Pvt Ltd. The Insurance

Regulatory and Development Authority of India (IRDA) has

approved the transfer of 26% to Diamond Dealtrade and 25.32% to

Enam Securities. Axis Capital acted as financial advisor

to Liberty International Holdings Inc - for identification of

new JV partner for its Indian general insurance business.

Silicon and Beyond

acquired by US-based Synopsys

Design & Reuse

US-based Synopsys, Inc. has acquired

Silicon and Beyond Private

Limited, a Bangalore-based provider

of high-speed SerDes technology used in data

intensive applications such as machine learning,

cloud computing, and networking. The acquisition

also adds a team of R&D engineers with

high-speed SerDes expertise to help designers

meet their evolving design requirements.

Sterlite Power acquires

Goa-Tamnar Transmission Project

Money Control

Sterlite Power has acquired the Rs 1,500 crore

Goa-Tamnar Transmission Project. The project

will deliver an incremental 400kV feed to Goa

and scale up the transmission network for power

evacuation from generation projects pooled at

Raigarh (Chhattisgarh).

Aspire Systems acquires

Polish IT Services firm Goyello

Times of India

Chennai-based Aspire Systems has acquired

Poland-based Goyello which provides IT

consulting, software development and mobile

solutions to clients in Europe and America. The

acquisition is expected to help Aspire launch

and scale up its nearshore presence in the

European market, with its primary delivery

center based in Poland. Following the

acquisition, Goyello’s team of 120 people will

be joining Aspire’s workforce across Poland and

Netherlands.

With this acquisition, Aspire Systems will have

its second largest development centre in Poland,

after Chennai. The company currently has over

2.300 employees and 120 customers globally.

Supreme Court upholds sale of

Park Hyatt Goa to ITC

Mint

The Supreme Court has upheld the sale of Park Hyatt Goa owned by Blue

Coast Hotels to ITC Ltd by Industrial Financial Corp. of India (IFCI),

against a Bombay High Court order. The SC has directed that the transfer

of the property title be done within six months.

Undone: Edelweiss ends

Rs.250-Cr deal to buy Religare’s securities unit

Mint

Edelweiss Financial Services Ltd’s acquisition

of Religare Enterprises Ltd’s securities

business has fallen through because Religare

failed to get the necessary regulatory

approvals. Edelweiss Financial, the wealth

management unit of Mumbai-based Edelweiss Group

had offered to buy the securities business of

Religare in December 2017 for about INR 250

crore (USD 38.5 million).

Undone: ZEE terminates

9X Media acquisition

Economic Times

Zee Entertainment Enterprises has terminated the

acquisition of music broadcaster 9X Media

announced in October 2017 due to “non-completion

of certain material conditions precedent”.

ZEE had agreed to pick up 100% stake in 9X Media

and its subsidiary INX Music for a total cash

consideration of INR 160 crore. Later, ZEE had

extended the long-stop date to facilitate the

investee entities of 9X Media to comply with

certain conditions for conclusion of the

transaction. New Silk Route, which owns about

80% stake in 9x Media, has been looking to exit

the company since 2013 after first investing in

INX Media, as 9X was formerly known, over 10

years back.

Other Deals

Cut-flower exporter Karuturi

raises funds from Phoenix Group

Business Line

Bengaluru-based Karuturi Global, the world’s largest producer of cut

roses, has raised funding from Singapore-based Phoenix Group to repay

debt and revive the Kenya operations. Karuturi’s Naivasha farm in Kenya

has 500 acres of land with 300 acres of greenhouses valued at over USD

100 million. The farm produces about 33 million roses annually for

export to Europe, accounting for 10% of Kenya’s exports of cut flowers.

Karuturi also has floriculture farming in India and Ethiopia, besides

interests in food processing, retailing and IT. Phoenix operates 10

business verticals in 22 countries.

Debt Financing

Alteria Capital invests INR 8.5

Cr in Fingerlix

Economic Times

Venture Debt firm Alteria Capital has made its first investment in

ready-to-cook food brand Fingerlix. The Mumbai-based startup, which is

backed by Accel Partners and Zephyr Peacock, raised INR 8.5 crore in its

first debt financing exercise. With this, the total capital raised by

Fingerlix reached INR 71.5 crore, including equity and debt.

Fingerlix will use the proceeds to build production capacity for its

existing presence in the country’s top six cities. The firm, which has a

kitchen in Mumbai, will build one in Delhi immediately and follow it up

with another for the southern market. Fingerlix will use a portion of

the fund to also boost its distribution channel and increase presence in

retail and other distribution outlets.

Real Estate

Transactions

Jai Corp's Jains buy sea-view

bungalow La Bonita for Rs.152-Cr

Economic Times

The promoter family of Jai Corp, including Gaurav Jain and his father

Satyapal Jain, have bought La Bonita — a sea-view bungalow in Breach

Candy from the Mehta family, who happen to be Sachin Tendulkar’s

in-laws. The deal is for INR 152 crore, including stamp duty of INR 7.25

crore.

The bungalow, also known as Mehta House, is a ground plus two-storey

structure with built-up area of nearly 20,000 sq ft. It is built on

around one-third of an acre in the country’s most expensive property

location. The transaction involved seven people as sellers, including

Anjali Tendulkar.

Godrej Fund

Management raises $600-M

Business Standard

Godrej Fund Management (GFM), the real estate

private equity arm of the Godrej group, has

raised $600 million in the first phase of two

new funds for investing in office projects.

The “Godrej Build to Core — I” (GBTC-I) fund, a

club-style office investment platform, has

raised $450 million. This will be invested to

develop Grade-A buildings across key locations.

APG Asset Management, which had invested in

other funds managed by GFM, will be the

cornerstone investor of GBTC-I.

The other new fund, “Godrej Office Fund — I”

(GOF-1), a discretionary blind pool, has raised

$150 million. The fund will invest in core and

core-plus offices and commercial properties

across the country.

Lighthouse Fund

raises $200-M third fund

Business Standard

Lighthouse Fund has closed its third round at

USD 200 million, taking total assets under

management to USD 500 million.

Fireside closes

first fund with Rs.340-Cr

Mint

Fireside Ventures, an early-stage venture

capital fund focused on consumer brands, has

closed its first fund with a corpus of INR 340

crore. Fireside is led by Kanwaljit Singh, Vinay

Singh and V.S. Kannan Sitaram. Investors in the

fund include FMCG giants like Unilever Ventures,

Emami Ltd, and ITC Ltd. Other prominent

investors including Premji Invest, Westbridge

Capital, Mariwala Family Office, Sanjiv Goenka

Family Office, and Sunil Munjal’s Hero

Enterprise Investment Office.

The fund also announced a new advisory board

including Amazon India head Amit Agarwal; Harsh

Mariwala, chairman, Marico Ltd; and Sri Rajan,

chairman, Bain & Co. India.

IREO

accused of $147-M fraud

Washington Post

Real estate investment company IREO has been accused of

defrauding its foreign investors to the tune of USD 147

million. Two global investment companies based in New York

and London, that have invested nearly USD 300 million in the

IREO, have filed a criminal complaint with New Delhi Police

last month alleging that the fund’s Indian managing

director, Lalit Goyal, co-founder Anurag Bhargava and others

were engaged in “large-scale fraud” by “illegally siphoning

off” at least USD 147 million of investors’ money.

Sequoia to cut

India fund size by 25%

Times of India

Venture Capital firm Sequoia is trimming the

size of its latest India fund by almost 25%.

Sequoia Capital was set to raise USD 650-700

million, which would be deployed across

internet, consumer and healthcare companies in

India as well as in Southeast Asia.

SoftBank

Managing Partner Kabir Misra exits Snapdeal board

Business Standard

SoftBank Capital’s managing partner Kabir Misra has exited

the board of beleaguered e-commerce firm Snapdeal. Misra was

appointed on the Snapdeal board last year to steer the

merger with Flipkart. The move fell apart in the face of

stiff opposition from many other shareholders.

VI

Updates

VI

Updates

Media Mentions

Startup go back to known

investors for double dip:

The Times of India

A Times of India article quotes Venture Intelligence data:

UrbanLadder raised $12 million from 4 existing investors in January this

year. In November last year, Accel

Partners pumped in Rs 100

crore

into their portfolio company Universal Sports Biz, Venture Intelligence

data said.

Fireside Ventures closes

first fund at Rs 340 crore backed by PremjiInvest, Unilever, ITC &

others:

The Economic Times

An ET article quotes Venture Intelligence data on fund raising by

consumer focused funds:

2017 alone saw investments worth $337 million in this sector, an almost

160% increase from 2016 and a 60% rise from 2015, data from Venture

Intelligence shows.

High Stakes:

Outlook Business

An Outlook Business' article on Private Equity investments and exits in

2017 quotes Venture Intelligence data:

Spark Capital

is one of India’s leading mid-market,

full-service Investment Banks. Having our

genesis from the south in 2001 and now

having a pan-India presence, we offer

services encompassing Investment Banking,

Institutional Equities, Fixed Income

Advisory and Wealth Advisory. Our key

differentiator is the ability to offer

services that benefit from an amalgam of the

experience of our founding members and the

contemporary thinking of our young

leadership team. Our core values of

integrity; putting customers first; and

seeking partnerships that are mutually

beneficial, help us build sustainable,

long-term relationships with clients. Our

services include equity and debt capital

raising in private and public markets; M&A

advisory; research-led public-market stock

ideation; and customised wealth advisory

solutions. Sectors where we have built

considerable domain strength and transaction

experiences are BFSI, Healthcare, Consumer,

Technology, Infrastructure and Industrials.

Our commitment to staying the course with

respect to our core values; our strong

entrepreneurial culture; an ability to

attract and retain high quality talent; and

our gradual expansion of markets and

services has served as cornerstones of our

evolution. Over the past three years, we

have advised on over 30 deals aggregating to

USD 1.8 billion; scaled up research coverage

to over 200 listed stocks; and rapidly grown

assets-under-advice on the back of

above-market performance of client

portfolios.

For more details please visit

www.sparkcapital.in

IHH bid values Medanta at about Rs.5,600-Cr

Mint

Malaysia’s IHH Healthcare Bhd has submitted a

bid to buy a controlling stake in Medanta-The

Medicity super specialty hospital.The bid values

the premier hospital at INR 5,500-5,700 crore

US-based private equity fund Carlyle Group owns

27% in Gurugram-based Medanta, while Singapore’s

Temasek Holdings Pte holds 18%. Cardiac surgeon

Naresh Trehan, his family and Medanta co-founder

Sunil Sachdeva own the rest

Oyo

in talks to raise $800-M from SoftBank,

others

Mint

Hotel rooms aggregator Oyo Rooms has

initiated talks to raise USD 500-800 million

in fresh funding. Oravel Stays Pvt. Ltd,

which operates Oyo Rooms, is in early talks

with existing investors led by SoftBank

Group and two new investors to raise its

next round.

In September, Oyo had raised USD 250

million, mostly from SoftBank Vision Fund.

Sunil Munjal-led Hero Enterprise had also

invested in the round, along with Oyo’s

previous shareholders Sequoia India,

Lightspeed Venture Partners and Greenoaks

Capital.

Aavishkaar-Intellecap Group to raise $75-M

Mint

Aavishkaar-Intellecap Group plans to raise as

much as USD 75 million in the next few months to

fund growth of its various businesses and to

invest in new ones. The Impact investing-focused

group operates its equity funds business through

Aavishkaar Venture Management Services;

investment banking, consulting and research

through Intellecap; extending working capital

and business loans to small and medium

enterprises through Intellecash, venture debt

through Intellecap and microfinance lending

through Arohan.

The capital will be used to fund businesses such

as IntelleGrow, a lender to small businesses,

and Tribe, an early-stage fintech company within

the group. The group is currently raising a USD

200 million India-dedicated fund and has started

formal talks to raise its first Africa fund.

Video sharing platform VuLiv to raise

$4-M in pre-series A funding

Economic Times

VuLiv, a tech-based media player startup,

which allows its users to view and share

on-device video content without internet, is

in talks with strategic investors to raise

USD 3-4 million in pre-Series A funding. The

money raised will be used as a growth fund

to launch new products and unlock global

value.

KKR, Carlyle, Gen Atlantic, others in

race to buy controlling stake in Pepe Jeans

India

Economic Times

Five global private equity funds including

KKR, Carlyle, General Atlantic and

Malaysia’s sovereign fund Khazanah have

submitted non-binding offers to purchase a

controlling stake in the Indian arm of Pepe

Jeans. The parent company of Pepe Jeans

India is seeking a valuation of INR 2,000

crore for the Indian business. Kotak IB

is advising the global parent on the

divestment of the Indian unit. Pepe operates

more than 200 branded outlets in India —

most of them franchisee-run — and its

products are also sold through more than

1,500 multi-brand outlets.

Tata Capital looking to exit Sai Life Sciences;

top PE funds in the race

Economic Times

Tata Capital is looking to exit the

Hyderabad-headquartered Sai Life Sciences in

which it has a 35% stake. Bulge-bracket private

equity funds have lined up for the proposed

transaction. Sai Life Sciences is among the best

performing companies in Tata Capital's

portfolio. It is a contract development and

manufacturing organization focused on providing

innovator pharma companies with drug discovery,

CMC development and CGMP commercial scale

manufacturing services.

The PE funds that are known to have expressed

interest in the company include General

Atlantic, Warburg Pincus, Apax Partners, Temasek

and True North. These funds have been

shortlisted for the due diligence stage.

Non-binding offers have given Sai Life Sciences

an equity value of INR 1500-1600 crore. Tata

Capital had picked up a minority stake at the

Sai Life Sciences for INR 185 crore in 2014 .

Investment bank Jefferies is running the

stake sale process.

IPOs

Warburg Pincus set to part exit via Lemon

Tree Hotels’ IPO

Mint

Buyout firm Warburg Pincus is set to make a

partial exit from its almost 12-year-old

investment in Lemon Tree Hotels Ltd, as the

company prepares to launch its initial

public offering (IPO) at the end of this

month. Lemon Tree Hotels will launch its INR

1,039 crore IPO on 26 March. The hotel

operator has set a price band of INR 54-56

per share for the IPO. At the upper end of

the price band, the share sale values the

company at INR 4,403 crore.

Warburg Pincus, which had invested

approximately INR 300 crore in 2006 for a

24% stake in the company, is selling a 12%

stake in the company through the IPO. At the

upper end of the price band, Warburg will

garner INR 529 crore (approx $81.2 million)

from the share sale.

As of 31 January, Lemon Tree operated 4,697

rooms in 45 hotels (including managed

hotels) across 28 cities in India. For nine

months ended 31 December 2017, Lemon Tree

reported a net profit of INR 12.59 crore on

a total revenue of INR 174.31 crore.

Aavas Financiers in talks with investment banks

to go public

Mint

Mortgage lender Aavas Financiers Ltd is in talks

with investment banks for an initial public

offering (IPO). The proposed IPO will include a

mix of primary and secondary share sale, with

existing investors Kedaara and Partners Group

selling part of their stakes. Aavas, earlier

known as AU Housing Finance, was the housing

finance business of Jaipur-based small finance

bank AU Small Finance Bank Ltd. In February

2016, Swiss investment firms Partners Group and

Kedaara Capital acquired it for INR 900-1,000

crore. In FY17, Aavas reported a revenue of INR

313.9 crore and a profit of INR 57.8 crore.

M&A

Debt-laden Ruchi Soya attracts bids up to

Rs.10,000-Cr for 51% stake

Business Line

Ruchi Soya Industries Ltd (RSIL), which is

currently undergoing bankruptcy proceedings,

has received 26 applications from Indian and

foreign conglomerates to acquire a 51% stake

in the company. The bidders are quoting

anywhere between INR 8,000 crore and INR

10,000 crore for 51% stake in the edible

oil-maker. Ruchi Soya had a total debt of

about INR 12,000 crore as of December 31,

2017.

The bidders include ITC, Patanjali Ayurved,

Emami Group, Sakuma Exports, Phoenix ARC,

AION Capital Partners, 3F Oil Palm Agrotech

and Singapore-based Musim Mas. Global

investment firm KKR, Indian subsidiary of

US-based Cargill Corp, Singaporean palm oil

company Golden-Agri Resources and Malaysia’s

Sime Darby Bhd are also in the race.

UltraTech offers Rs.7,266 Cr for 98.43%

stake in Binani Cement

BSE

Publicly listed UltraTech Cement has agreed

to pay INR 7,266 crore in return for 98.43%

stake in Binani Cement subject to

termination of IBC Proceedings and other

clearances.

IDFC looks to exit asset mgmt biz in Rs.4,000-Cr

deal: report

Times of India

IDFC has begun discussions with IndusInd Bank

and Citic CLSA, among others, to merge or sell

its asset management company (AMC). PE firm Apax

Partners too has reportedly evinced early

interest to pursue a deal. IDFC is expected to

ask for a Rs 4,000-crore payout — almost 6% of

the assets under management.

SC stays RCom sale to Jio; agrees to hear

SBI’s plea

Times of India

The Supreme Court stayed the sale of assets

of Anil Ambani-promoted RCom Consolidated to

elder brother Mukesh Ambani-promoted

Reliance Jio Infocomm (Jio) in view of who

should be refunded first out of the money

raised from the deal — banks who have lent

money to RCom, or Ericsson.

SBI had challenged a tribunal’s order, which

was upheld by the Bombay High Court,

allowing Ericsson to stake a claim on RCom’s

assets. RCom owes Indian lenders INR 42,000

crore. SBI argued that as a secured lender,

its claim took precedence over others. RCom

Consolidated incorporates ADAG’s Reliance

Communications, Reliance Infratel and

Reliance Telecom. Apart from SBI, 24 other

Indian lenders constitute the Joint Lenders

Forum. They had initiated a sale through

bidding for RCom Consolidated’s assets.

Orchid Pharma gets three final bids at par with

liquidation value

Economic Times

Ingen Capital, Fidelity Trading Corporation and

Union Quimico Farmacéutica are in the final race

to acquire distressed drug maker Orchid Pharma.

The offers made by all of them are at par with

the liquidation value of the company. Orchid

Pharma, which is facing financial claims of INR

3,500 crore, exports active pharmaceutical

ingredients (APIs) of antibiotics and has two US

Food and Drug Administration approved

manufacturing plants. It was referred to

bankruptcy court by Lakshmi Vilas Bank (LVB) in

the middle of last year.

Edelweiss, Hero Future eye Atha Group’s

solar assets

Economic Times

Edelweiss Group and Hero Future Energies are

among the bidders for solar assets of close

to 190 mw project capacity belonging to the

Kolkata-based Atha Group’s renewable energy

arm AMPL Cleantech. The assets include eight

solar assets across various locations

including Rajasthan, Karnataka, Maharashtra,

Telangana and Madhya Pradesh up for

evaluation.

New Ventures

Arvind in automotive fabrics JV with Adient

BSE

Publicly listed Arvind Ltd has formed a JV with

global automotive seating player Adient to

manufacture automotive fabrics. The joint

venture - Adient Arvind Automotive Fabrics -

will have its manufacturing base in Ahmedabad.

Adient will hold a 50.5% stake.

Nalco, Canada's Almex to set up JV in Odisha

Business Standard

National Aluminium Company Ltd (Nalco) is to

form a joint venture with Ontario (Canada)-based

Almex for the production of automotive-grade

aluminium. The project, estimated to cost INR

2500 crore, will come up at the downstream

aluminium park at Angul (Odisha) in the vicinity

of Nalco’s aluminium smelting unit. Nalco will

have the majority stake in the JV, which have an

annual production capacity of 60,000 tonnes.

India Ahoy!

Music streaming service Spotify to launch in

India

Business Standard

The world’s largest music streaming service,

Spotify, is looking to bring its service to

India, as it looks to boost growth and stay

ahead of rival Apple. The company has leased

office space in Mumbai. The company has also

made ex-Googler Akshat Harbola as its Head of

Market Operations in India.

People

Balesh Sharma to head the Vodafone-Idea

merged entity

BSE

The new entity that will be formed by the

merger of Vodafone India and Idea Cellular

Ltd will be headed by Balesh Sharma as the

CEO. Sharma is currently the chief operating

officer (COO) of Vodafone India. Akshaya

Moondra, currently the chief financial

officer at Idea Cellular, will be the CFO

and Ambrish Jain, currently deputy managing

director at Idea, will take over as COO of

the merged entity.

Vodafone India CEO Sunil Sood will join

Vodafone Group Plc’s Africa, Middle East &

Asia-Pacific leadership team.

Axis Bank senior executives Sidharth Rath, V.

Srinivasan resign: report

Mint

Sidharth Rath, head of corporate and transaction

banking, and V. Srinivasan, deputy managing

director at Axis Bank Ltd have quit. Rath’s exit

followed the hiring of S.M. Sundaresan, formerly

head of corporate banking at Standard Chartered,

as head of corporate banking at Axis Bank.

Srinivasan, who joined Axis Bank as executive

director-corporate banking in 2009, was elevated

as a director in October 2012. Earlier, he was

managing director and head of markets with J.P.

Morgan India.

Reliance ARC appoints Ravindra Rao as CEO

Business Standard

Reliance Asset Reconstruction Co (ARC), part of

Reliance Capital, has appointed Ravindra Rao as

its new Chief Executive Officer. Rao has taken

over as CEO from Asokan Arumugam..Rao was

earlier with Fullerton India, where his last

assignment was that of the CEO of the home

finance subsidiary.

Bharucha Delhi corporate partner Arjun Anand

joins Singhania

Legally India

Bharucha & Partners Delhi partner Arjun Anand

has joined Singhania & Partners as a partner. He

specialises in M&A and transactional law.

Former Tata Group GC Bharat Vasani joins CAM as

corporate partner

Press Release,

Economic Times

Bharat Vasani, former general counsel of Tata

group, has joined leading full service law firm

Cyril Amarchand Mangaldas as a corporate partner

of the firm. He will be based out of the firm's

Mumbai office. Prior to this, Bharat Vasani was

Legal Advisor to the Tata Group Chairman. His

areas of specialization include company law,

corporate and commercial laws, securities law,

capital market transactions, M&A transactions,

JVs, competition Law, employment Law and

property matters.

Regulatory News

Govt asks NBFCs to register with

financial intelligence unit

Mint

The government asked non banking financial

companies (NBFCs) to register with the

country’s financial intelligence unit (FIU-IND)

and report details of clients as per the

requirements under the Prevention of Money

Laundering Act.

Bankruptcy

PNB takes Hanung Toys to NCLT for Rs.2600-Cr in

outstanding loans

Economic Times

Punjab National Bank (PNB) is taking Hanung Toys

& Textiles, an NCR-based soft toys and home

furnishing company, to the bankruptcy court for

unpaid loans totaling INR 2,600 crore. The

corporate debt restructuring plan crafted

three-years ago failed to take off. This has led

to an increase in outstanding dues to INR 2,600

crore. There are about 15 lenders to the

company.

Bidders may be able to make only up to

30% bullet payment for stressed cos

Economic Times

The insolvency and bankruptcy regulator is

set to suggest that at least 70% of the

payment by the bidder of a company in the

bankruptcy proceeding be paid on a regular

basis and the remaining 30% be paid in the

form of bullet payment as a final payment by

the bidder to qualify for bidding. This is

indicated in a draft report on the

evaluation criteria of bids for bankrupt

companies prepared by the Insolvency and

Bankruptcy Board of India. The draft has

suggested that 70% of weightage should be

given to quantitative criteria which

includes upfront cash payment and fresh

capital infusion. The risk weightage for

qualitative criteria is 30% which include

reasonableness of financial projections,

track record, financial strength and prior

experience.

Varun Resources faces liquidation as

lenders reject resolution plan

Business Line

A clutch of 12 banks led by State Bank of

India has decided to liquidate Varun

Resources Ltd – once India’s biggest

liquefied petroleum gas (LPG) ship owner —

to recover dues worth some INR 2,000 crore,

after rejecting a resolution plan submitted

by a third party. The lenders’ decision

means that eight LPG carriers of Varun

Resources will be sold either through the

NCLT process or will have to be auctioned

through the Admiralty Law process, because

the ships have been “arrested” by the

Admiralty court at the behest of the crew

and the ships’ then manager – Fleet Ship

Management Inc — to recover their dues.

SBI Hong Kong branch challenges Binani Cement

resolution

Economic Times

State Bank of India’s (SBI) Hong Kong branch has

challenged the lenders’ decision to declare

Dalmia Bharat-Bain Piramal consortium the winner

for Binani Cement. This, together with

UltraTech’s renewed bid for Binani Cement has

added another chapter to the ever-changing

bidding script. SBI’s Hong Kong branch had given

a loan to a subsidiary of Binani Cement which

was guaranteed by the parent company. However,

the resolution plan approved by the lenders

provides for paying only 10% of the amount dues

which SBI HK is opposing.

Panel may favour giving NCLT power to halt

resolution

Economic Times

The panel reviewing the Insolvency and

Bankruptcy Code (IBC) may suggest that the

National Company Law Tribunal (NCLT) should be

empowered to halt resolution proceedings if

lenders agree. Currently, only the Supreme Court

can exercise powers under Article 142 of the

Constitution in cases that are pending in the

NCLT. The panel’s recommendation of 90% lender

support effectively gives likely buyers an

opportunity to enter into one-time settlement

with banks, operational creditors and employees

while bankruptcy proceedings are on.

Electrosteel bid: NCLT pulls up

resolution professional

Times of India

The National Company Law Tribunal (NCLT) has

ordered the resolution professional dealing

with Electrosteel Steels to communicate the

reasons for deciding the eligibility of two

bidders- Tata Steel and Vedanta - in three

days to Renaissance Steel India, which had

challenged the decision. The resolution

professional should record the reasons for

deciding on any issue during the course of

the process to select a resolution applicant

for a company facing insolvency. It then

went on to pull up the resolution

professional for not providing proof in

support of his decisions.

Renaissance Steel was among the four bidders

for Electrosteel and had challenged the

eligibility of the other bidders arguing

that Vedanta and Tata Steel had been found

to be guilty in cases related to their

operations in Zambia and the UK,

respectively.

VISA Steel gets interim stay on insolvency

proceedings

Economic Times

The Orissa High Court has granted an interim

stay on corporate insolvency resolution

proceedings against VISA Steel, a special-steel

producer, until its next hearing on April 12.

State Bank of India (SBI) had moved the NCLT to

initiate proceedings against the loss-making

firm under the Insolvency and Bankruptcy Code,

2016.

UltraTech challenges Binani sale to

Dalmia

Economic Times

UltraTech Cement is gearing up to challenge

the lenders' decision to pick its rival,

Dalmia Bharat as the winning bidder for

Binani Cement. UltraTech’s contention is

that its revised bid of INR 7,266 crore with

payment of 100% of unsecured creditors (up

by over INR 700 crore) should be included in

the final shortlist. UltraTech Cement had

submitted the revised bids with the National

Company Law Tribunal (NCLT) after the

Committee of Creditors, in its last meeting,

chose Dalmia Bharat-led consortium's offer

of INR 6,750 crore.

UK firm Liberty House’s bid for ABG

rejected

Economic Times

The lenders to ABG Shipyard, led by ICICI

Bank, have rejected the only bid they

received, from Liberty House, prompting the

resolution professional to opt for yet

another round of bidding. The new deadline

to submit binding bids is March 26. In the

last two occasions, London-based metals

group Liberty House was the only bidder for

bankrupt ABG Shipyard, which owes banks INR

18,245 crore. The bid failed to meet

lenders’ expectation following which a

decision was made to invite fresh bids.

Essar Steel’s lenders reject

ArcelorMittal, Numetal bids

Mint

Lenders to Essar Steel Ltd have decided to

reopen bidding for the debt-ridden steel

maker after declaring ArcelorMittal and

Numetal Mauritius Ltd ineligible. Bidding

will be open to all six companies which had

submitted expressions of interest in Essar

Steel in the first round of bidding.

ArcelorMittal and Numetal can also bid

provided they take “corrective action”. The

tentative deadline for fresh bids is 2

April.

Binani Cement RP moves court alleging

Rs.2400-Cr fraudulent transactions

Economic Times

In a fresh twist to the ongoing takeover

battle over Binani Cement resolution

professional (RP) Vijaykumar V Iyer has

moved the National Company Law Tribunal (NCLT),

Kolkata, alleging fraudulent transactions of

about INR 2,400 crore involving the

“corporate debtor” (Binani Cement) that are

“undervalued, extortionate, preferential.”

The RP has asked the court to take action

and “appoint an appropriate investigation

agency to investigate the directors of

Binani Cement and the counter parties.”

Sebi may impose trading curbs on cos undergoing

insolvency proceedings

Business Standard

The Securities and Exchange Board of India (Sebi)

may impose trading restrictions on shares of

companies that are undergoing insolvency

proceedings. The move is aimed at reducing

volatility in stock prices and curbing

manipulation of price-sensitive information. The

Sebi board may also announce more checks and

balances on algorithmic (algo) trading,

reduction of mutual fund costs and changes in

buyback and takeover regulations. Sebi is likely

to propose new rules for fiduciaries, such as

lawyers and chartered accountants, dealing in

the securities market but who are not registered

with the market regulator. Sebi will allow the

new promoters to breach the 75% shareholding cap

in order to infuse equity into the company. Sebi

could mandate higher disclosures prior to

debtors moving the National Company Law Tribunal

(NCLT).

Others

CBI books Totem Infrastructure in

Rs.1,394-Cr bank loan fraud

Business Standard

The CBI has booked Hyderabad-based

construction and infrastructure company

Totem Infrastructure Ltd, for allegedly

defrauding a consortium of eight banks to

the tune of over INR 1394 crore. Totem

worked as a subcontractor for several major

infrastructure companies. Its promoters

Tottempudi Salalith and Tottempudi Kavita

were named in a CBI FIR, registered on the

basis of a complaint from the Union Bank of

India.

Online marketplace ShopClues fires 50

Economic Times

Online marketplace ShopClues has laid off

between 45-50 employees across multiple

functions. The layoffs were made taking into

account individual performances. The firm’s

employee strength is believed to be between

1,150-1,200.

Solar auctions in Maharashtra, Karnataka put off

due to lack of bidders

Economic Times

Two recent solar auctions – one in Maharashtra

and the other in Karnataka – have failed to

attract enough bidders, leading to their

repeated postponement.

Maharashtra’s latest 1,000 MW solar auction

received bids of only 530 MW and thus had to be

postponed for the fourth time. Karnataka’s 1,200

MW auction for projects at the Pavagada Solar

Park drew bids of only 550 MW at the second

effort. With over 90% of solar equipment being

imported, solar developers have become cautious

ever since the Directorate of Safeguard Duty,

reacting to a complaint from local solar

manufacturers, proposed imposing 70% safeguard

duty on imported solar panels in January this

year on the grounds that such imports were

crippling local industry.

Essar Steel lenders to take a call on offers

made by Numetal, ArcelorMittal

Business Standard

The lenders of Essar Steel are to take a call on

the two offers made by Numetal Mauritius, a VTB

Bank of Russia-owned company and ArcelorMittal.

Both the bids are likely to be rejected with

lenders planning to seek second round of

bidding.

ArcelorMittal failed to clear the legal

eligibility test as the company and its promoter

LN Mittal had investments in two non-performing

assets in India - Uttam Galva Steels and KSS

Petron, respectively. Numetal bid may not clear

the eligibility test as 25% stake is held by a

trust in which a Ruia family member is a

beneficiary.

Global activist investor Elliott sets sights on

Fortis Healthcare

Times of India

The world’s largest activist investor Elliott

Management, which has caused several top

management exits and selloffs through activist

boardroom interventions, is mopping up Fortis

shares in a rare show of interest in a public

company traded solely on Indian exchanges.

The New York-based Elliott, which manages about

USD 40 billion globally, has taken on several

American and European corporate heavyweights in

its 40-year history, including Warren Buffett

when it blocked Berkshire Hathaway’s takeover of

energy company Oncor last year. It has scaled up

activist investments outside the US with

campaigns in 50-odd companies across 14

countries.

Cricketer Rahul Dravid lodges complaint against

Bangalore-based investment co

Mint

Former Indian cricket team captain Rahul Dravid

has lodged a complaint against a Bengaluru-based

Vikram Investment Company for cheating him of

INR 4 crore. He claims to have invested INR 20

crore in the company in 2014 on assurance of

getting higher returns, but was yet to get back

INR 4 crore to match his principal investment.

Ola, Uber drivers go on strike; impact

restricted mainly to Maharashtra

Business Today

Driver partners of cab-hailing firms Uber

and Ola - led by Maharashtra Navnirman

Vahtuk Sena, the transport wing of

Maharashtra Navnirman Sena - have gone on a

strike. While this indefinite strike was

expected to have impact across the country,

it has only affected business mainly in

Mumbai and Pune.

The strike has been called primarily because

drivers aren't earning enough to make ends

meet despite working for long hours every

day. According to reports, drivers in Uber

and Ola make around Rs 25,000-30,000 every

month, which is a far cry from what they

were reportedly promised initially. Another

pertinent issue plaguing the drivers is the

hike in fuel prices and the companies

reducing rates to attract more customers.

Economic Laws Practice

("ELP") is a leading full-service Indian law

firm established in the year 2001 by eminent

lawyers from diverse fields. The firm’s

Private Equity & Venture Capital practice

brings onboard a unique understanding of

commercial matters and legalese to be able

to provide effective solutions to all

stakeholders in a transaction. The team

looks at providing a bespoke legal service

experience, which is sector agnostic in

nature and driven towards successful

consummation of the relevant transactions.

ELP advises clients on all aspects of

private equity and venture capital

transactions, whether from a fund formation

perspective or a potential portfolio

investment or a relevant exit transaction.

Our services include right from

conceptualising a structure, to conducting

the legal due diligence exercise, to the

preparation of the relevant documentation,

to providing assistance to the final closure

including negotiations and corporate

secretarial assistance.

ELP is the firm of choice for clients

because of its in-depth expertise,

continuous availability, geographic reach,

transparent approach, competitive pricing

and most importantly the involvement of

partners in every assignment.

“Avalon Consulting, among Asia’s top-rated consulting firms, is proud to announce a partnership with Cordence Worldwide. With this partnership, Avalon becomes the 11th member firm of the partnership, which now has 3000+ professionals, a presence in 23 countries through 70+ network offices around the world. For more details click here”

Founded in 1989, Avalon Consulting is an international management consulting firm that offers services in growth strategy, business transformation and transaction support to clients across a wide range of sectors including Agribusiness, Automotive, Chemicals, Construction, Education, Engineering, FMCG, Healthcare, Pharmaceuticals and Retail. It has offices in Mumbai, Delhi, Chennai, Bangalore and Singapore serving clients across India, Middle East, South East Asia, China, Europe and the US. Avalon Consulting is a member firm of Cordence Worldwide, a global management consulting partnership.

Connect with Avalon Consulting on Twitter, Facebook and LinkedIn to receive interesting insights and updates.

Basiz is a high end and

specialized fund accounting service provider

with international footprints, with offices

in Mumbai, Chennai and Coimbatore in India,

besides Singapore, London and New York.

Basiz primarily focuses on servicing Fund

administrators, Hedge Funds, Mutual Funds,

Private Equity / Venture Capital Funds,

Family Offices, REIT Funds, Insurance

Portfolios and Managed Accounts.

Contact Information

Sesh A.V ACA, Managing Director

Basiz Fund Services Pvt. Ltd

M: +918286008554, E:

sesha@basizfa.com

http://www.basizfa.com

Spark Capital

is one of India’s leading mid-market,

full-service Investment Banks. Having our

genesis from the south in 2001 and now

having a pan-India presence, we offer

services encompassing Investment Banking,

Institutional Equities, Fixed Income

Advisory and Wealth Advisory. Our key

differentiator is the ability to offer

services that benefit from an amalgam of the

experience of our founding members and the

contemporary thinking of our young

leadership team. Our core values of

integrity; putting customers first; and

seeking partnerships that are mutually

beneficial, help us build sustainable,

long-term relationships with clients. Our

services include equity and debt capital

raising in private and public markets; M&A

advisory; research-led public-market stock

ideation; and customised wealth advisory

solutions. Sectors where we have built

considerable domain strength and transaction

experiences are BFSI, Healthcare, Consumer,

Technology, Infrastructure and Industrials.

Our commitment to staying the course with

respect to our core values; our strong

entrepreneurial culture; an ability to

attract and retain high quality talent; and

our gradual expansion of markets and

services has served as cornerstones of our

evolution. Over the past three years, we

have advised on over 30 deals aggregating to

USD 1.8 billion; scaled up research coverage

to over 200 listed stocks; and rapidly grown

assets-under-advice on the back of

above-market performance of client

portfolios.

For more details please visit

www.sparkcapital.in

Technology Holdings is an M&A and strategic advisory group that assists companies and private equity funds globally with their acquisition, growth and exit strategies. We are exclusively focused on creating strategic transactions for IT Services & BPO, Technology & SaaS, Analytics, Digital Transformation, Healthcare IT/BPO and Engineering Services companies. Technology Holdings has offices across India, USA and the UK.

|

|

|

For more information, please visit:

http://www.technology-holdings.com/

Write to us at:

anurag@technology-holdings.com

or call us at +91-9108671235

Deal Digest Daily

Delivered by email on all working weekdays, the

Deal Digest Daily newsletter summarizes Private

Equity / Venture Capital Investment & Exits,

IPO, M&A activity in India. Our coverage

includes not just completed deals, but "Deals in

the Making" as well: i.e., companies planning to

raise PE/VC funding or on the IPO path, looking

for acquisition etc. The Deal Digest also

includes news on new funds being raised,

executive movements and much more – making it

“start the day with” update for executives in

the Indian deal ecosystem.

It is a companion to the weekly Deal Digest that

is published each Friday.

Click Here to request a trial.

Recommend the Digest

Please note that the Deal Digest is a PAID FOR

newsletter.

We encourage forwarding of this newsletter to

your industry colleagues on a once-per-user

basis, provided you also copy

subscription@ventureintelligence.in

In return, we will be glad to provide your

referrals with free trial issues. Any other

unauthorized redistribution is a violation of

copyright law.

Other Venture Intelligence Products Databases PE Deal Database, Pvt Cos Financials Database, M&A Deal Database, PE RE Deal Database PE Reports, VC Reports, Directories, LP Directory. Click Here for details